What is Medicare Part D, What Does It Mean for Pharma?

Medicare Part D plans fill a coverage gap, giving members voluntary coverage for outpatient prescription drugs.

Source: Getty Images

- Prescription drugs were not covered for Medicare beneficiaries prior to 2006. But the passage of the Medicare Prescription Drug, Improvement, and Modernization Act developed Medicare Part D, a voluntary prescription benefit for Medicare patients.

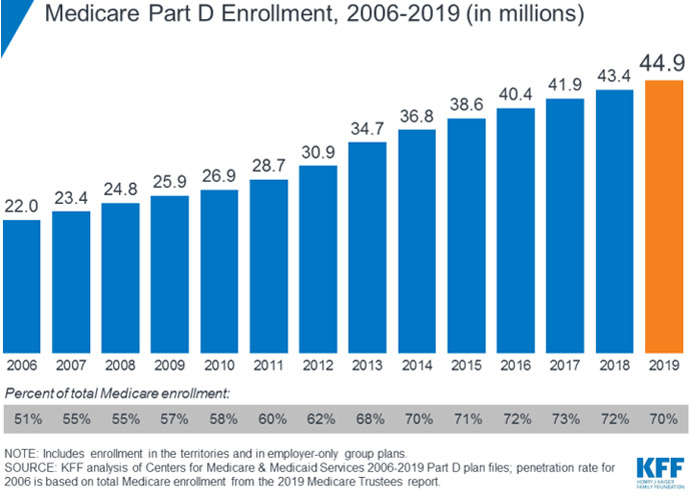

Medicare Part D plan offerings cover outpatient prescription medications. And enrollment has doubled since the start of the program. The plans now cover over 44.9 million Medicare beneficiaries.

Yet 12 percent of Medicare beneficiaries still lack credible drug coverage. Expanding plan offerings will provide more beneficiaries with access to medication at a lower cost burden, and Part D providers are doing just that. Plan offerings have expanded by five percent in 2020 alone.

“In listening to the people we serve, we know how much affordability and simplicity matter when it comes to their care and coverage,” Michael Anderson, chief executive officer of the Medicare Part D business at UnitedHealthcare told PharmaNewsIntelligence. “Part D plans or Medicare Advantage plans with prescription drug coverage can help with the cost of medications.”

What does Part D cover?

Medicare Part D plans provide supplemental prescription benefits to Medicare beneficiaries for outpatient prescription drugs. Members have the option to purchase a stand-alone Part D plan or have prescription benefits through Part C plans, which are a combination of hospital coverage (Medicare Advantage) and medical insurance (Medicare Part B).

Michael Anderson, CEO of Medicare Part D, UnitedHealthcare

Source: UnitedHealthcare“In assessing prescription drug coverage, we encourage people to consider the following when choosing a plan: your drugs, your pharmacy, and your total costs,” Anderson said.

Part D plans have formularies, or a list of medications covered by the plan. Before signing up for a plan option, Anderson encourages members to investigate if the medications they are taking are covered.

“Most Part D plans have preferred pharmacy networks and visiting these pharmacies typically means you can get your drugs for a lower copay,” he explained. “Search for a plan that offers access to convenient pharmacies.”

Beneficiaries must pay a monthly premium and deductibles, but plans are regulated by the Centers for Medicare and Medicaid Services (CMS). Base premiums hover around $32 but can vary from plan to plan, ranging from $12.18 to $191.40 a month.

Considering the total cost of medication is important as members select a plan.

“Plans sort drugs into several tiers, with generic or lower-tier drugs generally costing less than drugs on higher tiers,” said Anderson. “It can be wise to talk with your doctor about whether a generic or lower-tier drug might be appropriate for you to consider, which could help you save money.”

Formularies have tiers of coverage. The higher tier a medication is in, the costlier it is. But formularies can change throughout the year as therapies change, new drugs are released, and new medical information becomes available.

If the Food and Drug Administration (FDA) marks a drug as unsafe, health plans must also remove it from its formulary. Therefore, formularies can be ever-changing.

Patients must also be aware of potential coverage gaps in what a plan will pay for. These donut holes limit what a plan will cover, making the patient responsible for higher copayments after hitting this threshold. But not every member will meet this.

Source: Kaiser Family Foundation

“We strive to eliminate surprises for our members. Whether it involves the donut hole or any other benefit phase, we are proactive in offering our members the tools and assistance they need,” TJ Gibb, vice president of PDP management at Humana said. “Humana provides educational information about how the benefit phases work including guidance on the cost impacts and expectations of entering the next benefit phase. Members have access to their current out-of-pocket costs incurred to date as well as how much they will need to pay until they enter the next benefit phase.”

Many plans also provide monthly updates on a patient’s out-of-pocket expenses.

“Monthly Explanation of Benefits (EOB) statements show a member’s current benefit status and how this will impact their cost-sharing for prescriptions,” Anderson emphasized. “UnitedHealthcare proactively notifies members when they are nearing the donut hole to help limit any surprise at the pharmacy.”

Laura Hungiville, chief pharmacy officer and president, Envolve Pharmacy Solutions, Centene

Source: CenteneThe Affordable Care Act had a provision restricting the growth of out-of-pocket costs set to expire in 2019. In 2020, the threshold is set to increase from $5,100 to $6,340.

Navigating a Part D plan can, therefore, be confusing for members as they must keep track of premiums, deductibles, formularies, and coverage restrictions while also ensuring they do not hit a donut hole. This makes education key when developing Medicare Part D plans.

“As part of the enrollment and onboarding process, we work to educate members on the different benefit phases of the Medicare Part D program, including the donut hole,” Laura Hungiville, chief pharmacy officer and president of Envolve Pharmacy Solutions at Centene emphasized. “Over the past year, we have invested in enhanced digital tools that allow for easier tracking of Part D spending, including greater transparency around the amounts leading up to, during, and exiting the Donut Hole.”

Who Isn’t Covered by Part D?

Medicare patients are eligible for Part D supplemental plans, and over 70 percent of all beneficiaries take advantage of this benefit. But several plan options Medicare eligible patients have include prescription benefits, including most Medicare Advantage plans, Medicare Part C plans, Veteran Affairs coverage, and TRICARE. Patients on these insurance plans likely do not need supplemental prescription drug coverage.

In fact, with some plans such as employer-sponsored options, patients can actually lose their traditional medical coverage if they join a Part D or Medicare Advantage plan.

Medicare Supplement or Medigap policy plans can have prescription coverage as do Part C and most Medicare Advantage plans. Beneficiaries on these plans cannot purchase Part D coverage. So, members seeking additional drug coverage should ensure their current options do not cover the medication they need and that they are eligible to purchase a supplemental plan.

Members below the poverty line should also explore the Low-Income Subsidy Program. Beneficiaries below 150 percent of the federal poverty line or with modest assets are eligible for assistance and cost-sharing for Part D plans. There are 244 plans available for individuals low income subsidy with no premium, and approximately 13 million members are enrolled in these benefits.

“We know the importance of affordability and simplicity to our members and to consumers. We will continue to purposefully design our products to meet those expectations,” Anderson highlighted.

What do Part D plans mean for Pharma?

Step therapy or fail first methods are built into many Part D formularies. Patients often must try a plan’s preferred medicine and fail before receiving authorization to take the original medication a provider prescribed.

Not only can this lower patient adherence to medication, but it can also have detrimental effects on patient health outcomes. Delaying care often means patients must receive more costly and intense treatments when they finally receive care.

Yet the private-sector competition promoted by Part D plans encourages lower out-of-pocket costs for patients, highlighting affordable coverage to all patients.

TJ Gibb, vice president, PDP management, Humana

Source: HumanaThe balance between access to medication and cost of medication frequently teeters. To prioritize affordability, the Medicare Coverage Gap Discount Program promotes manufacturer discounts to all drug offerings in Part D plans. Only pharmaceutical manufacturers that signed a Discount Program agreement had its medications covered in Part D plans as of 2011.

Therefore, the pharmaceutical industry has a unique role to play in Part D plan negotiations. As creators of the drugs, it has bargaining power to lower costs for patients, improving access and affordability. PhRMA regularly comments on proposed addendums to Part D coverage restrictions in order to ensure these changes maintain a focus on affordability and patient-centered care.

Part D plans will continue to develop as the industry’s solutions grow. But PhRMA’s role will be to keep insurers in check and improving patient care at the center of this growth.

What is the Future of Part D?

As Part D plans are still in their infancy compared to other public plans, they continue to develop. A growing elderly population means more individuals will be eligible for Medicare and more individuals will need supplemental Part D coverage.

“As the needs and preferences of the Medicare-eligible population continue to evolve, we are committed to offering diverse plan options and a continued focus on improving the member experience through process and technological advancements,” Hungiville emphasized.

Patients are also expecting more options and benefits from their insurers.

“The Medicare eligible population continues to grow and health plans are expanding their Part D Prescription Drug Plan and Medicare Advantage offerings,” Gibb said. “Consumers are demanding more choice and access to the pharmacies of their choice. Consumers want the option to use mail order, their local pharmacy, a national chain or grocery store to obtain their medications.”

Federal regulation may drive Part D plan requirements, but payers continue to innovate and shape Part D offerings to meet patient needs.

“While the future evolution of Part D will be largely driven at the federal government level, we have seen the Part D program mature over the past 14 years and hope to see continued modernization to simplify the program for consumers,” Anderson concluded.